Falling prices for oil and gas have caused many explorers to slash their capital spending plans for 2015, and along with reduced spending, there’s been a reduction in drilling plans. Even companies that released a scaled-back program at the beginning of January are revisiting those plans and cutting back even further. Explorers are slashing their budgets by anywhere between 10% and 50%, and sometimes more. As a result, contract drillers and providers of oilfield tools and services are nervous about business this year.

Rig counts are one of the largest indicators of these spending cuts. According to service firm Baker Hughes, the number of rigs drilling for oil and gas in the United States fell to 1,192 in the first week of March, 75 rigs lower than the previous week, and 600 rigs lower than this time last year. Rig counts have fallen for 14 weeks in a row and are at their lowest level since Dec. 11, 2009.

Texas lost the most rigs during the period, dropping 32 in the week of March 6 and settling at 537, its lowest count since 2010. The Permian Basin took the biggest hit, dropping 24 oil rigs to settle at 328, its lowest since 2011. While the price of oil remains $45/bbl, it’s simply not worthwhile for most companies to drill.

The declines are hitting companies of all sizes. ExxonMobil said it would cut capex to $34 billion this year, about 12% lower than last year’s $38.5 billion, with capex for 2016 and 2017 expected to come in even lower. Chevron is planning a $35 billion capital budget for the year, about 12% lower than 2014.

At a tier below, ConocoPhillips cut its capital program to $11.5 billion, about 15% lower than the $13.5 billion it forecasted at the beginning of the year. EOG Resources is cutting its budget to $4.9-$5.1 billion, 4% lower than the $8.2 billion it spent last year, and Marathon Oil cut its budget to $3.5 billion, 20% lower than December forecasts and an overall 40% cut from the $5.9 billion budget it laid out in 2014.

The trend continues down to even the smallest players, with many suspending drilling plans altogether, spending just enough to maintain base production and secure leasehold interests. PetroQuest Energy has set its capital budget for 2015 at $60-$70 million, 65% lower than 2014 spending, and Resolute Energy has set its capital budget for 2015 at $45-$50 million, down 70% from the $159.8 million it spent in 2014. Even those who are continuing to drill are renegotiating contracts with service companies and providers of oilfield tools, banking on being able to secure at least a 20% reduction in drilling and completion costs.

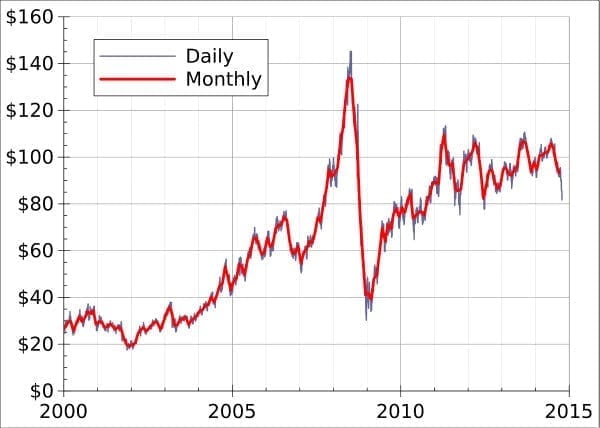

It’s difficult to predict when these trends will change. According to the Energy Information Administration, the average WTI crude spot price fell to $47/bbl in January, down from $59/bbl in December. The January average was the lowest level since February 2009. The story for gas isn’t quite as grim, though the EIA expects Henry Hub spot prices to average $3.05/MMBtu in 2015, $1.34/MMBtu lower than 2014 levels.

Although the cutbacks in drilling are likely to drive a rebound in prices, it may take some time for production to fall in line with the scaled-back spending. Despite the capex cuts, U.S. oil production has continued to climb largely due to higher-yield shale wells, the EIA says. Output for the week ended February 27 rose 39,000 bo/d versus the previous week to top 9.32 MMbo/d, the highest level since the EIA began tracking weekly data in 1983. The agency expects overall US oil output to climb to 9.3 MMbo/d, the highest since 1972.

There does seem to be hope on the horizon. The EIA expects WTI crude prices to average $55/bbl in 2015, rising to $71/bbl next year. And because the lion’s share of a well’s production comes in the first 18 months it’s on stream, many players are drilling wells but leaving them uncompleted, allowing them to quickly ramp up volumes should prices rebound.